Just like a treasure map, this guide will help you navigate the complexities of wealth-building and unlock the powerful strategies that can lead to a prosperous life. You’ll discover how to effectively manage your finances, invest wisely, and cultivate a mindset geared toward success. By applying these principles, you’ll be on your way to transforming your financial future and embracing the freedom that comes with financial stability. Get ready to take control of your money and your life!

Understanding Wealth

A clear understanding of wealth is necessary for anyone looking to improve their financial situation. At its core, wealth is not just about having a large sum of money in the bank; it encompasses a broader spectrum of resources that can provide you with security and opportunities. True wealth integrates financial assets, emotional well-being, and the power of personal connections into a holistic view of abundance in life. Possessing wealth means having the ability to make choices and live on your own terms, granting you the freedom to pursue your passions and aspirations without the constant worry of financial constraints.

How to Define Wealth

To define wealth effectively, you must first consider its various forms. While many people associate wealth primarily with money, this perspective is limiting. Wealth can be experienced in numerous ways, including time, health, and relationships. It is important to recognize that your wealth should encompass not only financial abundance but also the experiences and connections that enrich your life. The true measure of wealth lies in how fulfilled and empowered you feel in all aspects of your existence.

Important Factors Influencing Wealth

On your journey to building wealth, various factors will influence your progress and outcomes. Your ability to accumulate and maintain wealth depends on your mindset, education, investment habits, and the economic environment in which you operate. By understanding these elements, you can better navigate obstacles and take advantage of the opportunities that arise. Additionally, your social network can play a significant role in providing access to resources, knowledge, and mentorship that can enhance your financial situation.

- Mindset – Cultivate a growth mindset that encourages you to learn and adapt.

- Education – Invest in your personal and professional development to increase your financial literacy.

- Investment Habits – Establish solid investment strategies that align with your goals.

- Economic Environment – Stay informed about market trends and economic conditions that may impact your wealth.

- Social Network – Build a supportive community that fosters collaboration and the sharing of resources.

With time and intention, you can harness the power of these influencing factors to enhance your journey towards wealth. Understanding not only what affects your financial status but also how you can actively shape those influences will empower you to grow. You will find that maintaining a positive mindset and surrounding yourself with a motivated support system will significantly contribute to your long-term success. The potential for wealth is within your reach if you commit to taking the necessary steps.

- Mindset – Your beliefs about money shape your financial reality.

- Education – A well-rounded education can open doors for opportunities.

- Investment Habits – Smart investment choices lead to financial growth.

- Economic Environment – Awareness of broader economic conditions is vital.

- Social Network – A strong network can provide significant advantages in wealth accumulation.

Harnessing the Power of Money

There’s a fundamental truth about money: it can be a powerful tool for achieving your goals and aspirations. Learning to harness this power involves understanding not just how to earn and spend, but also how to manage and grow your finances effectively. When you take control of your money, you can unlock opportunities that may have seemed out of reach, allowing you to build a path toward financial freedom and success. By equipping yourself with the right strategies, you can ensure your financial decisions work in harmony with your goals.

Tips for Budgeting Effectively

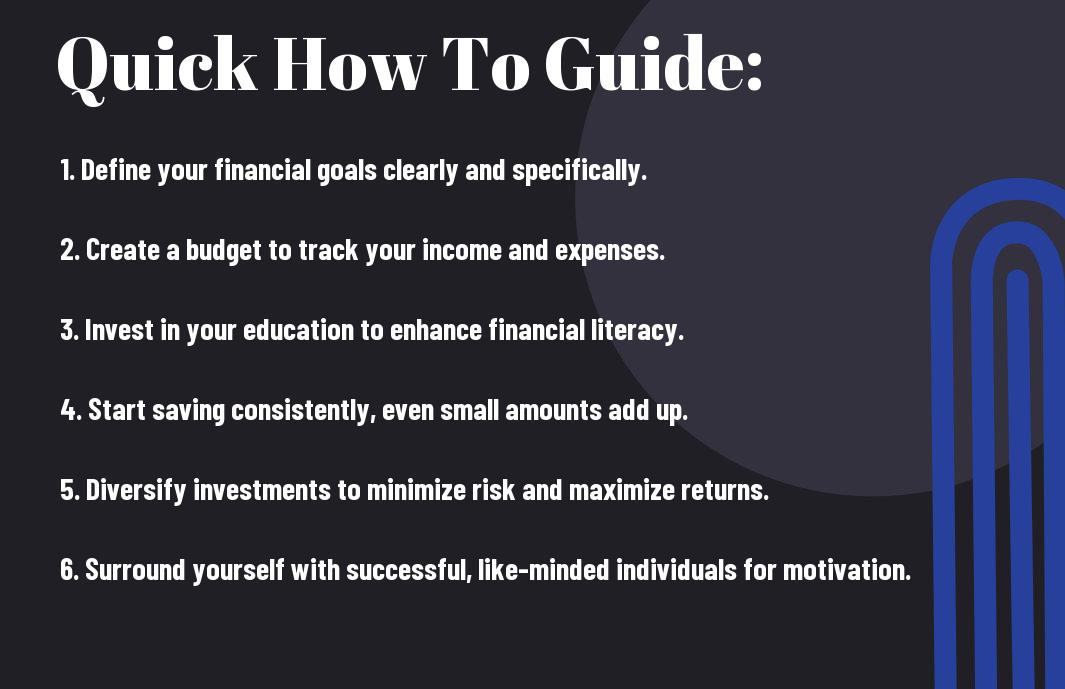

One of the first steps toward harnessing the power of money is creating a manageable budget that reflects your lifestyle and financial goals. A well-crafted budget not only helps you track your expenses but also creates a roadmap for savings and investments. Here are some tips to help you budget effectively:

- Identify your fixed expenses, such as rent and utilities.

- Track your variable expenses, including groceries and entertainment.

- Set specific savings goals, such as a vacation or retirement fund.

- Regularly review and adjust your budget to accommodate lifestyle changes.

Assume that you commit to this budgeting process consistently, and you’ll begin to see the impact on your financial health.

How to Invest Wisely

If you’re ready to take your financial journey a step further, investing wisely is key to building wealth over time. This involves understanding the various types of investments available, such as stocks, bonds, and real estate, as well as their associated risks and returns. You should assess your risk tolerance, set clear investment objectives, and diversify your portfolio to mitigate potential losses. Seeking advice from financial professionals or doing thorough research can help you make informed decisions that align with your financial aspirations.

This journey into investing requires diligence and a proactive approach. With each investment decision you make, assess the potential for growth against the risks involved. Focus on long-term strategies rather than trying to time the market, as this can often lead to poor financial decisions. Pay close attention to market trends, economic indicators, and the overall health of your investments. Taking calculated risks can change your financial landscape significantly, contributing positively to your wealth-building journey.

Mindset for Success

For anyone seeking to achieve financial prosperity, cultivating the right mindset is crucial for unlocking your potential. Your mindset frames your approach to wealth, influencing how you perceive opportunities, challenges, and your own capabilities. A wealth mindset is not merely about having a desire for money; it encompasses positive beliefs about your abilities to generate, manage, and grow wealth. It involves fostering an attitude of abundance, where you see opportunities rather than obstacles and believe that your efforts will lead to success. By adopting this perspective, you lay the foundation for your financial journey.

How to Cultivate a Wealth Mindset

Even small daily habits can significantly shift your mindset towards wealth. Start by practicing gratitude for what you currently have, which helps create a sense of abundance in your life. Additionally, regularly visualize your goals and outcomes; this reinforces your belief in your ability to achieve them. Surround yourself with individuals who inspire you, as their positive energy can encourage your own growth mindset. Always seek knowledge through books, podcasts, and workshops focused on wealth building and financial literacy. These strategies develop your mental muscles, aligning your thoughts with your goals.

Overcoming Mental Barriers

You may encounter mental barriers on your path to financial success, often manifested as self-doubt or limiting beliefs about money. Recognizing that these barriers stem from past experiences or societal messages is the first step in overcoming them. Challenge the narrative that suggests money is inherently bad or that you do not deserve a wealthy lifestyle. An effective way to dismantle these barriers is through self-reflection; evaluate your beliefs about money and assess whether they serve your goals or keep you stagnant. Transform negative thoughts into empowering affirmations that reinforce your capability and worthiness of success.

Cultivate your awareness of the language you use regarding money, as it can greatly impact your mindset. Shift from phrases like “I can’t afford that” to “How can I afford that?” to foster a solution-oriented mindset. Identify recurring thought patterns that limit your potential; it’s often within these thoughts that you find room for growth. By replacing limiting beliefs with an empowered narrative, you pave the way for a mindset where wealth is not merely a distant goal but an achievable reality within your reach.

Building Multiple Income Streams

To create a robust financial future, one of the most effective strategies is to build multiple income streams. This approach not only provides you with stability during economic fluctuations but also accelerates your journey toward wealth. By diversifying your income, you reduce reliance on a single source, enabling you to explore different avenues where you can accumulate resources. It allows you to make your money work for you, increasing your financial security and enabling you to enjoy life more fully.

How to Identify New Opportunities

If you want to identify new opportunities for income generation, start by evaluating your existing skills and interests. Think about how you can leverage your current expertise while exploring complementary fields. Conduct thorough research on market trends, looking for gaps where demand exceeds supply. Additionally, consider talking to peers and industry professionals to gain insights into emerging trends and opportunities that you may not be aware of. Networking can reveal pathways that align with your passion and expertise.

Tips for Diversifying Your Income

Your ability to diversify your income can significantly impact your financial health. Begin by exploring different types of income sources such as passive income, freelance work, or investments. Look for opportunities that allow you to utilize your existing knowledge or explore new interests. To successfully diversify, keep the following tips in mind:

- Invest in real estate for rental income opportunities.

- Consider creating digital products like eBooks or online courses.

- Collaborate on joint ventures to leverage others’ networks and resources.

- Explore stock market investments or mutual funds for potential growth.

Assume that you actively seek and implement these strategies; your income potential will significantly increase.

Streams of income shouldn’t just be a one-size-fits-all approach. Along with diversifying, it’s important to assess your risk tolerance and the level of commitment you’re prepared to invest. Consider testing new opportunities on a small scale before diving in fully, allowing you to gauge potential returns without overwhelming your resources. Always stay adaptable, and be open to refining your approaches if some streams don’t yield desirable results. Keeping an eye on market demands and innovation can ensure that your income streams remain viable and profitable in the long term. Assume that with persistence and strategic thinking, you can create a sustainable financial future through multiple income channels.

Networking and Relationships

Now that you understand the importance of wealth-building, one key aspect you cannot overlook is the power of networking and relationships. Building a robust network of contacts can open doors to opportunities and resources you may never have considered. The people you surround yourself with can significantly affect your success, so you should focus on creating meaningful connections that can bolster your journey toward financial freedom and personal growth. Networking is not just about exchanging business cards; it’s about cultivating deep, lasting relationships that can lead to mutual benefits and support.

How to Build a Strong Network

With a strategic approach, you can effectively build a strong network that propels you forward. Begin by identifying your goals and the type of individuals whose expertise or influences can aid in achieving them. Attend relevant events, conferences, workshops, and seminars where you can meet like-minded individuals or leaders in your field. Online platforms like LinkedIn are also excellent resources to initiate connections and engage in discussions that showcase your skills and interests. Make it a habit to follow up after meetings, not only to solidify your connection but to explore opportunities for collaboration.

Factors That Foster Successful Partnerships

Foster successful partnerships by focusing on the crucial factors that contribute to their strength and longevity. Building a network involves trust, communication, and mutual respect. Establishing a trusting atmosphere allows partnerships to blossom, while clear and open communication ensures that all parties are aligned in their goals. A few other important factors include:

- Shared values

- Mutual benefits

- A growth mindset

- Reciprocity

This mindset not only enhances your existing relationships but can also pave the way for new alliances that can contribute positively to your ambitions.

Strong partnerships can significantly accelerate your journey toward wealth and success. By focusing on building relationships characterized by strong communication, cooperation, and shared goals, you can create a network that amplifies your capabilities. Seek individuals who can challenge you, support you, and, importantly, complement your skills. By investing in others and nurturing these connections, you can develop a thriving network that supports your pursuit of wealth and personal achievement. This holistic approach to networking empowers you to take control of your success.

Continuous Learning and Adaptation

Many successful individuals recognize that the journey to wealth is not a destination but an ongoing process. The world around you is ever-changing, and to truly harness the power of money and success, you must commit to continuous learning. Investing in your education and staying informed can provide you with the insights needed to make informed financial decisions and identify emerging opportunities. In this fast-paced environment, your ability to adapt can ultimately dictate your financial success.

Tips for Staying Informed

There’s a wealth of resources available to help you stay informed about financial trends and market shifts. By incorporating a few strategic habits into your routine, you can enhance your knowledge and awareness:

- Subscribe to reputable financial news outlets and newsletters that provide regular updates on market conditions.

- Engage with industry podcasts and webinars that discuss evolving financial strategies and success stories.

- Join online forums or communities where you can converse with like-minded individuals and exchange valuable insights.

- Attend local seminars or workshops that focus on money management and investment strategies.

This proactive approach will not only keep you informed but also provide you with diverse perspectives on wealth creation.

How to Adapt to Changing Markets

Any successful investor understands that markets are in constant flux, requiring a flexible mindset. To adapt effectively to these changes, you need to analyze trends, recognize patterns, and be prepared to pivot when necessary. This may involve diversifying your investments to mitigate risks or aligning your strategies with the latest developments, whether they stem from economic shifts, technological innovations, or consumer behavior changes. The more quickly you embrace change, the better equipped you will be to seize opportunities that others may overlook.

This approach means staying vigilant and being willing to invest time in market research and data analysis. When you notice a pattern, such as a decline in a particular sector, reassessing your investments or exploring alternative options may safeguard against losses. Conversely, recognizing a rising trend can lead you to capitalize on growth opportunities. As you hone your ability to adapt, remember that flexibility and a willingness to learn from failures are important components of your journey toward building wealth.

Summing up

Hence, as you commence on your journey to unlock the secrets to wealth, it’s vital to recognize that the power of money is not merely about accumulation but about the mindset and strategies you employ. By understanding the principles of wealth-building, setting clear financial goals, and cultivating habits that promote success, you can create the life you envision. This guide serves as a compass, directing you towards practical steps that can lead to financial independence and personal fulfillment.

Moreover, embracing a growth-oriented mindset allows you to view challenges as opportunities for learning and improvement. As you implement the strategies outlined in this guide, focus on continuous education, networking, and adapting to changing circumstances. Your financial journey should not just be about achieving wealth but also about nurturing your overall well-being and contributing positively to your community. With dedication and the right approach, you can harness the power of money to build a prosperous future for yourself and those around you.

- My Friend Dog - March 16, 2025

- My Friend Dog - March 16, 2025

- Unlocking the Secrets to Wealth – A Guide on How to Harness the Power of Money and Success in Your Life - January 6, 2025

Views: 2