Success in life is often intricately tied to your understanding of financial abundance and your relationship with money. In this comprehensive exploration, you will uncover the positive strategies that can transform your financial mindset, turning objectives into tangible results. You’ll also learn about the dangers of negative thinking and poor financial practices, fostering a pathway towards sustainable wealth. This deep dive will empower you to align your financial goals with your vision of success, enabling you to thrive both personally and professionally.

Understanding Financial Abundance

For many, the journey towards financial abundance commences with the understanding of what it truly means. Financial abundance is more than just a number in your bank account; it encapsulates a profound sense of security, freedom, and opportunity. It refers to a state where you have enough resources not only to cover your basic needs but also to pursue your dreams and aspirations without constant worry. When you reach this level of abundance, money can act as a tool to enhance your life experiences rather than a source of stress.

Defining Financial Abundance

Financial abundance often manifests itself through wealth creation, responsible spending, and strategic investments. The concept encompasses various dimensions, including emotional well-being and the ability to cultivate relationships and experiences that enrich your life. It’s crucial to recognize that financial abundance differs from person to person; what constitutes abundance for you may not hold the same value for someone else, and that’s perfectly acceptable. Ultimately, financial abundance means achieving a balance between wealth and a fulfilling lifestyle.

The Psychological Aspects of Wealth

Against the backdrop of societal norms and pressures, understanding the psychological aspects of wealth is vital. Many individuals grapple with self-limiting beliefs about money, often tied to upbringing or cultural conditioning. These beliefs can manifest as guilt, fear, or even shame related to finances, leading to unhealthy relationships with money. The mindset with which you approach wealth can be as influential as the money itself; shifting your perspective can facilitate a healthier interaction with financial resources.

Due to these psychological factors, you may find yourself feeling overwhelmed or unworthy when it comes to financial success. By recognizing and addressing these internal barriers, you can foster a mindset that embraces wealth as a natural and attainable state. Embracing positivity around money can lead to new opportunities and a healthier relationship with your finances, ultimately assisting you in achieving that coveted state of financial abundance. Understanding that your psychological predispositions shape your interactions with wealth can empower you to rewrite your financial narrative for the better.

The Money-Success Connection

While many people often see money and success as two separate entities, the reality is that they are intricately connected. Your perception of money can powerfully influence your overall success in life, shaping not only your financial decisions but also your approach to opportunities and challenges. Understanding and harnessing this connection can lead you toward a fulfilling path where financial abundance is not merely a goal but a natural byproduct of your efforts and mindset.

Furthermore, recognizing how money impacts your confidence, relationships, and even career choices can shift your perspective significantly. Financial abundance doesn’t just signify wealth; it embodies the freedom to pursue your passions, build lasting relationships, and achieve personal growth. By rewiring your mindset to embrace wealth as an necessary component of your success, you can actively work towards mastering both your finances and your life.

Money Mindset and Success

Above all, your money mindset is a powerful determinant of your financial outcomes and overall success. This mindset encompasses your beliefs, attitudes, and feelings about money, shaping how you interact with it daily. If you perceive money as scarce or believe it’s inherently tied to negative experiences, it can hinder your ability to attract wealth and opportunities. Conversely, cultivating a positive money mindset that views wealth as a tool for growth and empowerment can open doors to new possibilities and experiences.

Success is not solely about the amount of money you earn; it involves creating a life rich in meaning and fulfillment. By fostering a healthy relationship with money, you pave the way for innovative thinking, resilience, and resourcefulness—traits necessary for long-term success. You have the power to challenge and reshape limiting beliefs about your finances, freeing you to create a reality that aligns with your goals and aspirations.

Strategies for Cultivating Wealth

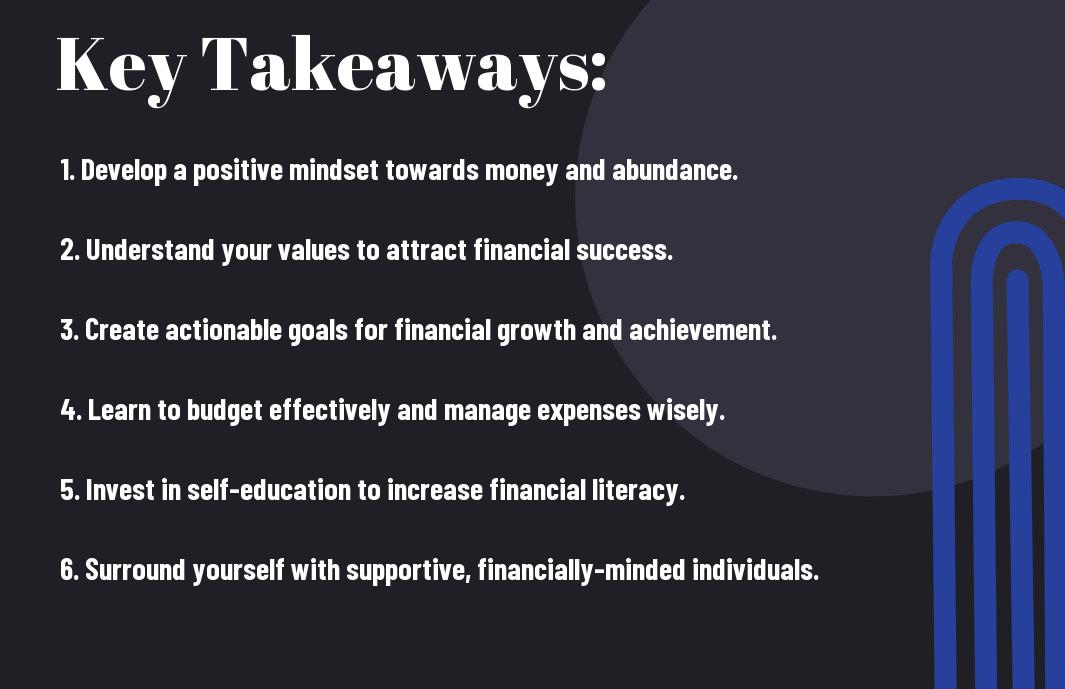

Cultivating wealth involves more than simply saving money; it requires adopting a mindset of abundance and employing strategic practices. These practices can range from setting clear financial goals and using budgeting techniques to diversifying your income streams and investing wisely. Learning and implementing these strategies is imperative to ensuring your finances grow harmoniously alongside your personal and professional development.

MoneySuccess is not an elusive dream; it can be achieved through intentional actions and a proactive mindset. Regularly reviewing your spending habits, nurturing your financial literacy, and seeking opportunities for investment can significantly enhance your financial well-being. Moreover, surrounding yourself with a supportive community that shares your values and encourages your ambitions can contribute positively to your wealth journey, reinforcing your belief in your ability to achieve financial abundance.

Overcoming Financial Obstacles

After examining the relationship between money and success, it’s important to recognize that you may encounter various financial obstacles on your path to achieving financial abundance. These barriers can stem from both external factors, such as economic downturns or lack of resources, and internal struggles, like fears or misconceptions about money. Acknowledging these obstacles is the first step toward redefining your financial narrative and paving the way for success. By facing them head-on, you empower yourself to take control of your financial destiny.

Identifying Limiting Beliefs

Between your aspirations for financial success and your current situation lies a web of limiting beliefs that may hinder your progress. These beliefs often manifest as negative thoughts that tell you you’re not deserving of wealth or that financial abundance is unattainable for someone in your position. Identifying what these beliefs are is imperative; they might include ideas like “money is the root of all evil” or “I will never be financially stable.” By pinpointing these mental barriers, you can begin to unravel the underlying fears that shape your financial reality.

Practical Steps to Financial Freedom

Any journey toward financial freedom begins with actionable steps that create a lasting change in how you interact with money. Start by setting clear financial goals that align with your values. Breaking these goals down into manageable tasks allows you to track your progress and stay motivated. Additionally, cultivating a savings habit can set the foundation for your financial journey; consider automating your savings to ensure you’re consistently putting money aside. Reviewing your expenses regularly will also shed light on areas where you can cut back and redirect funds toward your goals.

With these practical steps in place, you significantly enhance your chances of achieving financial abundance. Create a budget that reflects your priorities, ensuring you’re allocating your resources effectively. Educate yourself on financial literacy, exploring topics like investment strategies and debt management, to empower yourself in financial decisions. In doing so, you not only lay the groundwork for your financial future but also foster a more positive relationship with money that supports your aspirations for success.

The Role of Education in Financial Success

Unlike many other aspects of life, financial success is greatly influenced by your level of education. While some may argue that financial abundance can be achieved without formal schooling, it’s important to recognize that the insights and skills gained through education provide you with a significant advantage. Understanding complex financial concepts allows you to make informed decisions, plan for your future, and navigate the often tumultuous world of investments and savings strategies. In essence, education serves as a powerful tool that can shape your financial journey and lead you to opportunities you may not have encountered otherwise.

Moreover, your financial literacy can greatly affect your ability to build and sustain wealth. The more knowledgeable you are about money management, budgeting, and investment strategies, the better equipped you will be to tackle challenges that come your way. Embracing education means embracing a mindset of continuous learning—an vital quality for achieving financial success.

Financial Literacy and Its Importance

Below the surface lies the underestimated yet vital aspect of financial literacy. This foundation allows you to understand not only how to manage your money, but also the more intricate workings of debt, interest rates, and investment terminology. When you possess a high level of financial literacy, you are less likely to make poor financial choices and fall victim to predatory financial practices. Thus, investing your time in enhancing your financial knowledge directly correlates with your ability to achieve substantial success.

Furthermore, many people find themselves overwhelmed or intimidated by financial discussions. By actively seeking to improve your financial literacy, you equip yourself with the ability to engage in thoughtful conversations about wealth-building strategies and economic issues. With a solid foundation of knowledge, you will feel empowered to take control of your financial future, making informed decisions, and setting realistic goals.

Resources for Building Financial Knowledge

With the right resources at your disposal, you can take proactive steps towards enhancing your financial education. There are countless books, podcasts, online courses, and workshops designed to help you better understand all aspects of personal finance. Exploring these resources will enable you to grasp the fundamentals of budgeting, investing, and credit management, providing you with a well-rounded understanding of how to achieve your financial goals.

In addition to traditional learning methods, many community organizations and nonprofit groups offer workshops and seminars focused on financial literacy. These programs often cover topics ranging from basic budgeting techniques to advanced investment strategies. Engaging with these options not only expands your knowledge base but also allows you to connect with others who share similar financial aspirations. Take the initiative to seek out the resources that resonate with you, and you’ll unlock the potential for greater financial security and success in your life.

Investing for Abundance

Once again, the journey to financial abundance requires more than just saving your money; it demands smart investing. By actively engaging in investment opportunities, you pave the way for your wealth to grow. Harnessing the right investment strategies not only allows you to accumulate wealth but also positions you to benefit from the power of wealth compounding over time. As you initiate on this financial voyage, keep in mind that the decisions you make today will have a profound impact on your financial future.

Different Investment Avenues

The landscape of investment avenues is vast and offers various pathways to grow your wealth. You can choose from traditional options like stocks, bonds, and mutual funds, which have been proven to yield substantial returns over time. Alternatively, you may prefer investing in real estate, which can provide both immediate income through rental properties and long-term capital appreciation. Additionally, consider exploring more contemporary avenues such as peer-to-peer lending, cryptocurrencies, or crowdfunding platforms that present innovative investment opportunities. With each of these choices, it’s crucial to assess your own risk tolerance and long-term financial goals to find the right fit for you.

The Power of Compound Interest

Above all, the power of compound interest is perhaps one of the most significant factors in building your wealth. Compound interest, simply put, is the interest on your investment that is calculated based on both the initial principal and the accumulated interest from previous periods. This creates a snowball effect: the longer you let your money grow, the more prosperous your future can become. Start early and make consistent contributions, and you’ll be rewarded with exponential growth in your returns.

Plus, an understanding of how compound interest works can profoundly influence your investment strategy. By reinvesting your earnings instead of cashing out, you are effectively amplifying the growth of your portfolio. To illustrate, if you invest just a small amount of money regularly and allow it to accumulate over the years, the results can be staggering due to the exponential nature of compound interest. This is why starting your investment journey as soon as possible can help you capitalize on this remarkable financial principle, turning a modest investment into a future of financial abundance. Therefore, make it a priority to educate yourself on compound interest and incorporate it into your investment decisions for maximum wealth growth.

Building a Supportive Network

Not realizing the impact of a solid support system can limit your potential in achieving financial abundance. When you surround yourself with people who uplift and motivate you, you create a fertile ground for growth and success. Your community plays a significant role in shaping your beliefs about money. Positive reinforcement from those around you can inspire you to pursue your financial goals with renewed vigor. Engage with those who possess a mindset oriented towards success, as they can provide insights and knowledge that enhance your financial journey.

The Influence of Community

Community plays an important role in your financial well-being and success. When you are part of a group that shares similar aspirations, the collective energy can be contagious. You may find that the challenges you face are easier to navigate when you have a network of individuals who understand your journey. They can offer advice, share experiences, and motivate you to stay committed to your financial objectives. The camaraderie and accountability fostered within your community can propel you forward and serve as a buffer against setbacks.

Networking for Financial Growth

Network strategically to maximize opportunities for your financial advancement. The relationships you build can open doors to invaluable resources, mentorship, and business connections that may otherwise remain inaccessible. Engaging with individuals who have achieved financial success can provide you with insights that are both practical and inspirational. These contacts can also help you refine your strategies, learn about available resources, and keep you informed about market trends that may affect your financial decisions.

Growth in your financial standing often stems from your willingness to reach out and connect with others. By expanding your network, you’ll not only gain valuable knowledge and potential partnership opportunities but also create a support system that reinforces your commitment to achieving financial abundance. Dive into events, attend workshops, or simply engage with online communities that resonate with your goals. The more robust your network becomes, the more likely you are to uncover opportunities for collaboration that can drive your financial success.

To wrap up

Drawing together the insights from this exploration of financial abundance, you begin to see that the relationship between money and success is not merely about amassing wealth but understanding how to cultivate a mindset conducive to growth. As you incorporate the principles discussed here, it’s important to recognize that your financial journey is unique and influenced by your values, goals, and efforts. By developing a positive attitude towards money, you can shift your perspective on success, allowing you to embrace the opportunities and challenges that come your way.

Your path to financial abundance is a continuous process of learning, adapting, and aligning your actions with your vision of success. Engaging in mindful spending, investing in your education, and nurturing relationships that foster financial literacy can dramatically enhance your ability to create and sustain wealth. As you implement these strategies, keep in mind that success goes beyond the balance sheet; it encompasses personal fulfillment, resilience, and the impact you have on the world around you. The journey is yours to navigate, and with the right approach, you can unlock the secrets to a prosperous future.

- My Friend Dog - March 16, 2025

- My Friend Dog - March 16, 2025

- Unlocking the Secrets to Wealth – A Guide on How to Harness the Power of Money and Success in Your Life - January 6, 2025

Views: 3