Freedom takes on new dimensions when you learn to manage your finances effectively. Understanding your money is the key to financial independence and achieving your personal goals. In this informative post, you’ll discover practical strategies that empower you to take control of your finances, build wealth, and ultimately unlock the doors to success. By implementing these strategies, you’ll transform not just your financial situation but your overall quality of life.

Understanding Financial Freedom

For many, the term ‘financial freedom’ can feel nebulous or elusive. However, it is a tangible goal that you can work towards achieving. At its core, financial freedom means having sufficient personal wealth to live comfortably without being burdened by debt or financial stress. This encompasses not only having enough money to cover your daily expenses but also being equipped to handle emergencies, save for long-term goals, and invest in opportunities that promote your overall wellbeing. The pathway to financial freedom is not necessarily linear, but understanding the components that contribute to it is vital for your journey.

Defining Financial Freedom

Understanding what financial freedom looks like for you is important. It can range from being debt-free to having the freedom to pursue passions without the constraint of financial worries. It often involves creating multiple income streams and having the ability to make choices that enrich your life. No matter how you define it, establishing clear criteria for your own financial freedom will serve as your guidepost, helping you formulate actionable plans that align with your specific goals and values.

The Importance of a Financial Mindset

Around the pursuit of financial freedom lies the concept of a financial mindset, which significantly impacts your ability to achieve lasting wealth. This mindset encompasses your attitudes, beliefs, and habits regarding money, along with your willingness to learn and adapt. By cultivating a positive financial mindset, you empower yourself to take calculated risks, embrace opportunities, and make informed decisions that can lead you toward financial independence. It shifts your perspective from a scarcity mentality to one of abundance, allowing you to see potential where others may see obstacles.

Defining a sound financial mindset requires that you actively challenge preconceived notions about money. You should focus on learning, drawing knowledge from both successes and setbacks, and keeping an open mind to new financial strategies. Prioritizing financial education and self-reflection will aid you in breaking free from limiting beliefs and foster a more prosperous relationship with your finances. By embracing this mindset, you truly equip yourself with the tools and knowledge that fortify your path to financial freedom. Ultimately, it’s about taking control of your resources and navigating your life with intention, ensuring that your aspirations are within reach.

Budgeting and Saving

Assuming you want to achieve financial freedom, mastering the art of budgeting and saving is paramount. A well-planned budget not only helps you track your income and expenses but also empowers you to make informed financial decisions. By understanding where your money goes each month, you can identify areas where you might be overspending and allocate your resources more effectively. This not only minimizes unnecessary expenses but also allows you to prioritize your saving goals, paving the way for a more secure financial future.

Creating an Effective Budget

For building an effective budget, start by listing all your sources of income along with your fixed and variable expenses. Fixed expenses might include rent or mortgage, utilities, and loan payments, while variable expenses can cover groceries, entertainment, and personal spending. Once you have a clear picture, aim to allocate a percentage of your income towards savings and investments. Refine this allocation over time; a budget is a living document that can be adjusted as your financial situation changes, ensuring you remain on track to meet your long-term goals.

Strategies for Saving More

Among the most effective strategies for saving more is automating your savings. By setting up automatic transfers to a savings account right after you receive your paycheck, you can ensure that you save before you even have the chance to spend that money. This method reduces the temptation to dip into other funds and helps you build a savings cushion over time. Additionally, adopting the 50/30/20 rule, where you allocate 50% of your income to needs, 30% to wants, and 20% to savings, can guide your spending behavior and maximize your savings.

At the same time, consider implementing the envelope system for variable expenses. By physically dividing your cash into envelopes labeled for specific spending categories, you bring a tactile element to your budgeting. This method can make you more aware of your spending habits, significantly reducing the likelihood of overspending. Moreover, be sure to track your savings progress regularly; seeing your savings grow can be a powerful motivator to stay committed to your financial goals.

Investing Wisely

All investors must start by understanding the fundamentals of investing to successfully navigate the financial landscape. Investing is the process of allocating your money to different assets, such as stocks, bonds, and real estate, with the expectation that they will generate a return over time. It is crucial to recognize that investing is not merely a game of chance; rather, it requires careful planning, strategic thinking, and a solid grasp of market principles. By building a strong foundation in the basics of investing, you position yourself to make informed decisions that can enhance your financial stability and growth.

The Basics of Investing

Investing involves risk versus reward; the more risk you are willing to take, the greater your potential for gains. You should consider your financial goals, risk tolerance, and the time frame you have when selecting your investments. Familiarize yourself with terms like asset allocation, which refers to dividing your investment portfolio among different asset categories, and compounding, which is the process where your investment earnings generate additional earnings over time.

Building a Diversified Portfolio

Building a diversified portfolio is a key strategy to mitigate risk and maximize potential returns. By spreading your investments across different asset classes, industries, and geographies, you can protect your portfolio from significant losses that may occur in any one area. A well-diversified portfolio allows you to take advantage of various market conditions while ensuring that your overall investment risk remains manageable.

To achieve effective diversification, you should include a mix of stocks, bonds, and other alternatives in your portfolio. Consider allocating a portion of your investments to international assets to further enhance diversity. Keep in mind that, while diversification can safeguard against losses, it won’t completely eliminate the risk of losing money. Your goal should be to balance your investments in such a way that they perform well both individually and in concert with each other, ultimately leading to a more stable financial future.

Eliminating Debt

After you have made the decision to pursue financial freedom, the next vital step is to focus on eliminating debt. This process begins with identifying the types of debt that may be holding you back from reaching your financial goals. Understanding the differences between these types can help you prioritize which debts to tackle first.

Identifying Types of Debt

Any effective strategy for debt elimination starts with a clear understanding of the types of debt you carry. Here’s a breakdown of common debt types:

| Secured Debt | Debt backed by an asset, such as a mortgage or car loan. |

| Unsecured Debt | Debt not tied to any specific asset, such as credit cards or personal loans. |

| Revolving Debt | A borrowing limit that can be used repeatedly until reaching the cap, such as credit cards. |

| Installment Debt | Debt that is paid back in fixed payments over time, like car loans. |

| Student Loans | Debt incurred for education; can be either secured (federal) or unsecured (private). |

After identifying your debts, you can create a targeted plan to address them effectively. Prioritizing high-interest debt can save you money in the long term and propel you faster towards financial stability.

Strategies for Debt Reduction

About developing strategies for debt reduction, you should focus on consolidating your debts, negotiating lower interest rates, and creating a budget that allows you to allocate a portion of your income towards paying off debt. Setting clear, achievable goals can also inspire you and increase your chances of success.

Debt can feel overwhelming, but taking active steps can turn the tide in your favor. By exploring options like the debt snowball method, where you focus on paying off the smallest debts first, or utilizing a debt avalanche approach that prioritizes higher interest debts, you can systematically reduce what you owe. These methods not only help you be effective in your payments but also build your confidence as you see tangible results over time. After implementing these strategies, you’ll find that tackling your debt becomes a more manageable and less daunting issue, bringing you closer to your financial freedom.

Building Multiple Income Streams

Not having multiple income streams can severely limit your financial potential and expose you to risks that could jeopardize your lifestyle. By diversifying your income sources, you create a safety net that ensures you’re not wholly dependent on a single paycheck. This strategy not only provides you with more financial security, but it also opens up opportunities for wealth accumulation and helps you achieve your financial goals faster. The power of money lies in its ability to generate more of itself, and by leveraging different income streams, you put that power to work for you.

Exploring Passive Income Options

Along your journey toward financial freedom, exploring passive income options is a game-changer. These are sources of income that require initial effort but subsequently generate revenue with minimal ongoing involvement. Popular choices include investing in stocks, rental properties, or creating digital products like eBooks or online courses. With the right strategies, these avenues can provide you with substantial income while freeing up your time to pursue other interests or income-generating opportunities.

Side Hustles That Work

Around your primary job, you might find that a well-chosen side hustle can significantly enhance your overall income. Side hustles not only offer a chance to earn extra money but can also serve as a testing ground for your entrepreneurial aspirations. Think about activities that align with your skills and interests—freelancing in your field, consulting, or monetizing a hobby can all be viable side hustles that can potentially grow into substantial income sources. The key is to select something that excites you yet remains manageable to sustain alongside your full-time commitments.

To ensure your side hustle stands out, focus on a niche that resonates with your skills and the needs of your target audience. Research market demand and gauge competition to identify opportunities that you can leverage. Whether you choose to offer freelance services, engage in affiliate marketing, or start a small online shop, the potential for financial growth is vast, and the journey can be incredibly rewarding. Just make sure to set clear goals and allocate your time efficiently to balance both your primary job and your side venture for the best results.

The Power of Financial Education

Despite the abundance of financial resources and tools available today, many individuals still struggle to make informed financial decisions. The way you manage your money significantly impacts your ability to achieve financial freedom and ultimately dictates your success. Understanding the principles of finance empowers you to navigate complex economic challenges and seize opportunities that can lead to wealth accumulation. Financial education isn’t just about understanding how money works; it helps you build a resilient mindset that can withstand market fluctuations, inflation, and unexpected expenses.

Importance of Continuous Learning

An imperative aspect of financial education is the commitment to continuous learning. The financial landscape is constantly evolving, influenced by technological advancements, regulatory changes, and shifting economic trends. By keeping yourself informed about these developments, you position yourself to make smarter investment choices, improve your budgeting skills, and create sustainable financial plans. Engaging in ongoing education acts as a safety net that prevents you from falling prey to outdated strategies or common financial pitfalls.

Resources for Financial Education

By leveraging a variety of resources, you can enhance your financial knowledge and skills tailored to your unique goals and needs. Online courses, podcasts, books, and financial blogs all serve as excellent tools to expand your understanding. Some platforms even offer free resources that cover everything from basic budgeting to complex investment strategies, giving you a comprehensive foundation to build on as you progress in your financial journey.

Hence, it is important to take advantage of different educational resources that can enlighten you on finance-related topics. Consider exploring well-reviewed books written by financial experts, subscribing to reputable financial podcasts, or enrolling in online courses that offer in-depth knowledge at your pace. Participating in community workshops or attending local seminars can also provide practical insights and networking opportunities. The more you engage with diverse educational materials, the more equipped you will become in making informed financial decisions that align with your aspirations.

To wrap up

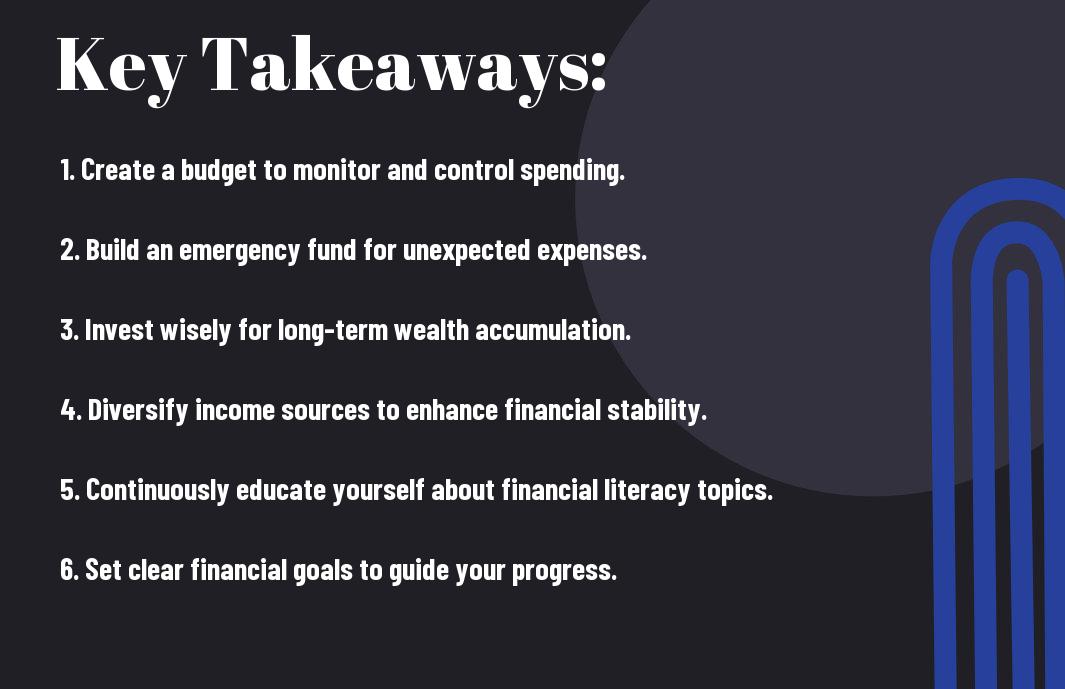

Hence, as you begin on your journey toward unlocking financial freedom, it is vital to implement the practical strategies discussed throughout this guide. By setting clear goals, maintaining a well-structured budget, and investing wisely, you can cultivate a mindset that not only transforms your relationship with money but also empowers you to achieve lasting success. Recognize that mastering your finances is an ongoing process that requires commitment and adaptability, but the rewards of financial security and independence are well worth the effort.

Your financial journey is uniquely yours, and embracing the steps outlined here will enable you to harness the power of money effectively. With persistence and strategic planning, you can create the financial future you desire, ultimately paving the way for opportunities that enhance your overall quality of life. Seize the knowledge and tools at your disposal, and take deliberate actions towards achieving the financial freedom you envision.

- My Friend Dog - March 16, 2025

- My Friend Dog - March 16, 2025

- Unlocking the Secrets to Wealth – A Guide on How to Harness the Power of Money and Success in Your Life - January 6, 2025

Views: 3